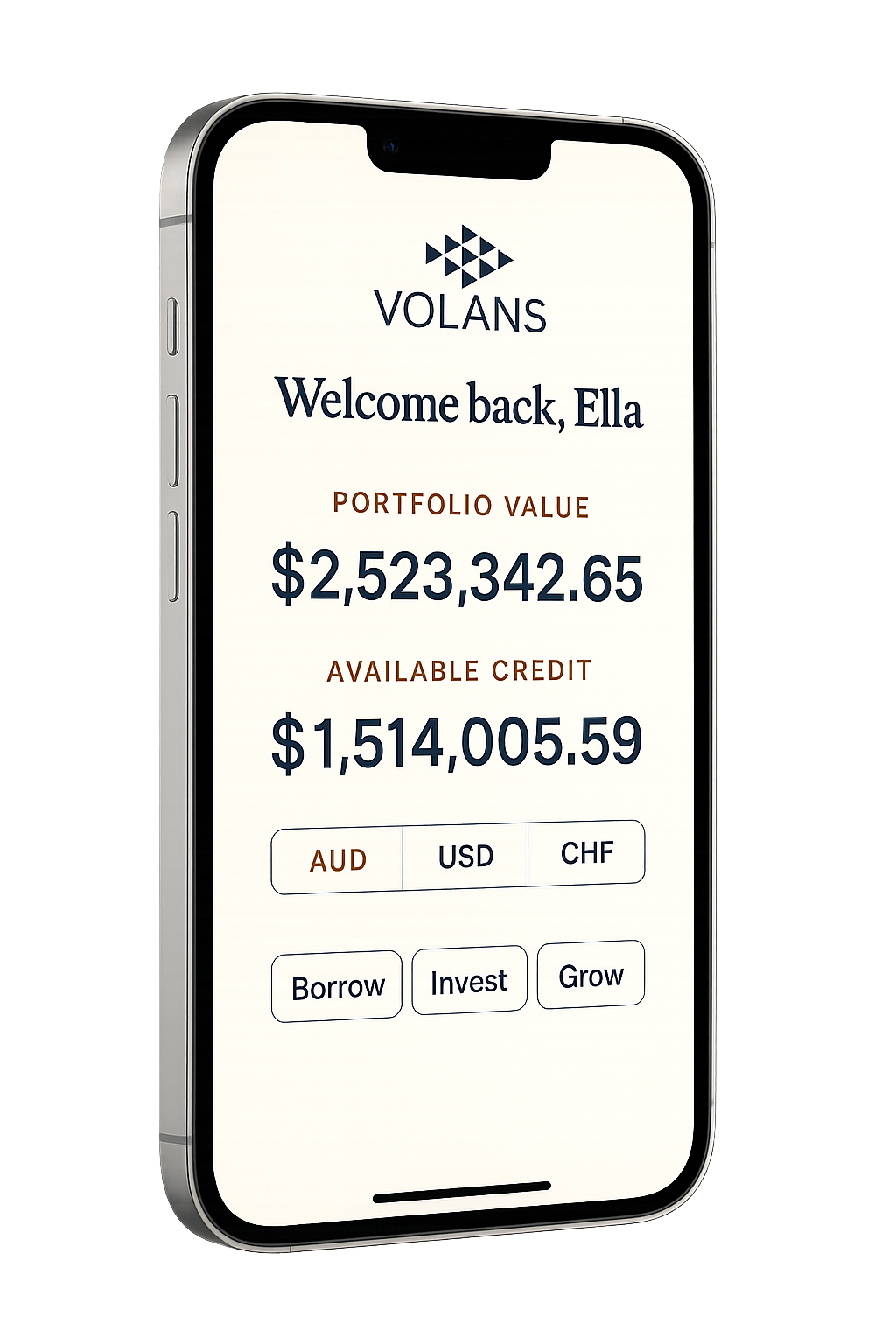

Borrow and Invest without Borders

Multi-Currency Access · Portfolio-Backed Credit · Institutional Infrastructure

Your global line of credit — powered by your portfolio. Borrow in 25+ currencies against 27,000+ securities. Secured by your shares.

(Australian Financial Services License - 537864)

As seen in:

A Smarter Way to Borrow and Invest

Volans integrates everything investors need to manage capital efficiently — from portfolio-secured credit and global execution to transparent reporting and custody. It’s a single, intelligent ecosystem built for those who expect institutional performance without institutional friction. Because your capital should move as intelligently as you do.

The Future of Liquidity

We rebuilt lending for Investors

Faster. Smarter. Borderless. We removed the banks and everything that slowed you down.

Ultimate Flexibility

Pledge over 27,000 + global securities. Where banks restrict, Volans unlocks. Your portfolio becomes your passport.

Global Access

Borrow and invest in 25 + currencies — all from one digital platform. Your liquidity moves with you.

Unbeatable Cost

A licensed non-bank with no branches or legacy overheads. Transparent pricing. Institutional discipline. Lower cost to you.

30+ Years Experience

Australian-licensed margin lender, regulated by ASIC and backed by three decades of institutional banking & lending expertise.

Retain Assets in Your Name

You retain full legal title. Assets are held in Trust with Tier One Global Banks, approved custodians or ASX participants.

Access Cash in Hours not Days

Access liquidity within 24 hours of lodging collateral — with streamlined approvals and digital onboarding.

Embedded Connectivity

Seamlessly integrate Volans’ lending and liquidity infrastructure into your existing broker, wrap or platform via APIs.

Where are you looking to Invest today?

How it works

Three steps. Institutional discipline — without the friction.

-

Open your account

Start online via our website or app (wholesale clients only).

-

Link your wealth manager or adviser

We connect your existing adviser, broker or platform — seamlessly.

-

Access your credit line

Your eligible assets are verified and remain in trust. Funds available in hours to borrow or invest globally.

Volans is an Australian-licensed margin lender regulated by the Australian Securities & Investments Commission (AFSL 537864).

Start in minutesLet Your Capital Go Further

Real capital is the ability to act — without forced selling, tax leakage or bank delays. Here’s how investors and advisers use Volans portfolio-secured liquidity in practice.

Reinvest Into Markets

Redeploy capital quickly to capture new opportunities while your core portfolio stays invested and compounding.

Learn more →Meet Liquidity & Cashflow Needs

Access liquidity for ATO obligations, capital calls or short-term cash requirements — without forced selling.

Learn more →Refinance Expensive Debt

Replace high-cost facilities with efficient, portfolio-secured credit to optimise carry and improve flexibility.

Learn more →Bridge Strategic Acquisitions

Bridge an acquisition, investment or asset purchase while long-term financing is finalised — without delay.

Learn more →Expand Across Borders

Borrow in one currency and deploy in another. Move capital internationally and act where opportunity actually is.

Learn more →Access Private Markets & Alternatives

Fund private equity, venture, real assets and off-market deals — without liquidating core listed positions.

Learn more →