Discover our Financing Solutions

Use your shares to fund lifestyle decisions

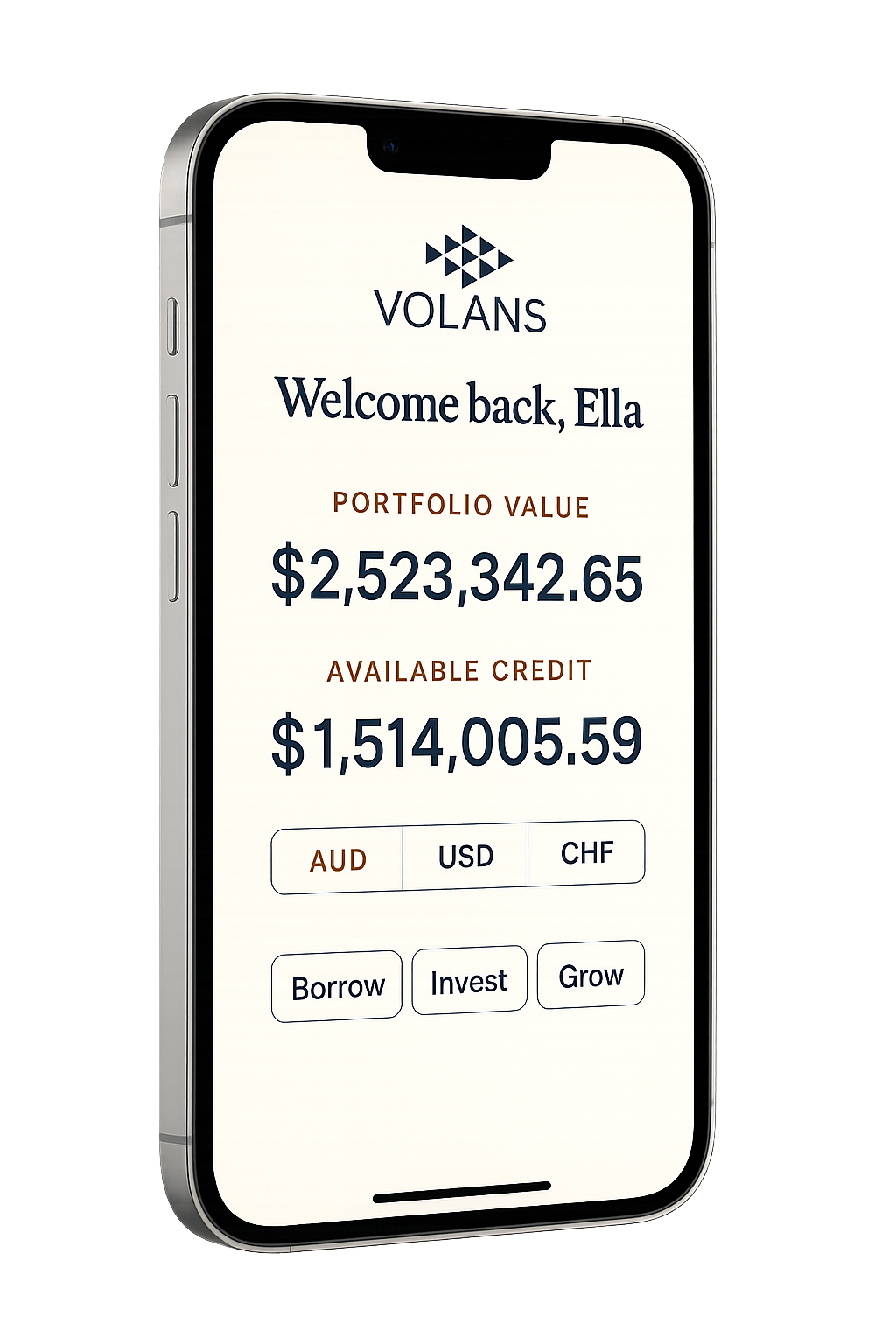

Volans financing solutions are designed for high-net-worth investors who prefer to access liquidity from their portfolio rather than rely on unsecured borrowing or sell assets at the wrong time. A Volans facility turns your portfolio into a source of liquidity—providing flexibility while preserving long-term investment positions.

-

A disciplined, portfolio-secured credit facility designed for sophisticated investors.

Volans Credit allows investors to access liquidity against eligible securities while assets remain in approved custody. Credit limits are established using conservative eligibility criteria and continuously monitored against portfolio values.

This solution is suited to investors seeking:

Liquidity without selling investments

Multi-currency borrowing against global portfolios

Institutional risk management and transparency

Ongoing monitoring and disciplined margin controls

Credit availability adjusts with market movements. Risk is actively managed and clearly understood at all times.

-

Tailored financing for complex portfolios, structures and investment strategies.

For investors with concentrated positions, cross-border holdings or unique balance-sheet requirements, Volans designs bespoke credit arrangements in collaboration with counterparties and advisers.

These solutions may include:

Custom collateral pools or eligibility rules

Structured credit aligned to specific assets or strategies

Multi-jurisdictional or multi-currency requirements

Financing aligned to family office or holding-company structures

Each solution is individually assessed, structured and governed to institutional standards.

When to consider our services

You want to access liquidity without disrupting core holdings

You see opportunities ahead but prefer to keep your portfolio intact

You’re seeking to diversify or rebalance in a more capital-efficient way

You require capital for significant personal or investment decisions

You prefer disciplined, secured financing over unsecured alternatives

Please note: this image is for illustration purposes only

Simply a better way to access liquidity

Designed for HNW investors

A credit framework built around significant, well-constructed portfolios—not short-term leverage or speculation.

Disciplined, institutional-style credit

Structured loan-to-value parameters, ongoing monitoring and transparent risk management, providing certainty and control.

Freedom in how you use funds

Invest into new ideas, diversify holdings, refinance existing arrangements or access liquidity—within clearly defined terms.

Works alongside your existing setup

Designed to sit alongside your current advisers, custodians and investment arrangements, not replace them.

Volans is a financial services business of Glide Digital Pty Ltd (ABN 97 654 421 066, AFSL 537864), a licensed Australian margin lender. Volans products and services are available only to wholesale clients (as defined in sections 761G and 761GA of the Corporations Act 2001) and are not available to retail clients. The information on this website is general information only and has been prepared without taking into account your objectives, financial situation or needs. It does not constitute personal advice, or an offer, recommendation or solicitation in relation to any product or service. You should consider whether this information is appropriate for you and obtain independent legal, financial and tax advice before making any decision.